PENGUMUMAN

- Semua Info

- Akademik

- Kemahasiswaan

- Umum & Keuangan

Berita & Informasi

Tanggal 26 April 2024 , Direktorat Kemahasiswaan Universitas Brawijaya telah menyelengarakan kegiatan Pemantapan Materi Kompetisi Mahasiswa Nasional Bidang Ilmu Bisnis, Manajemen, dan Keuangan (KBMK) Tingkat Universitas Brawijaya 2024 . kegiatan yang berlangsung di UB Guest House . Kegiatan ini dilaksanakan dalam rangka pemantapan materi dari 5 bidang yang akan dikirim oleh Universitas Brawijaya dalam tingkat […]

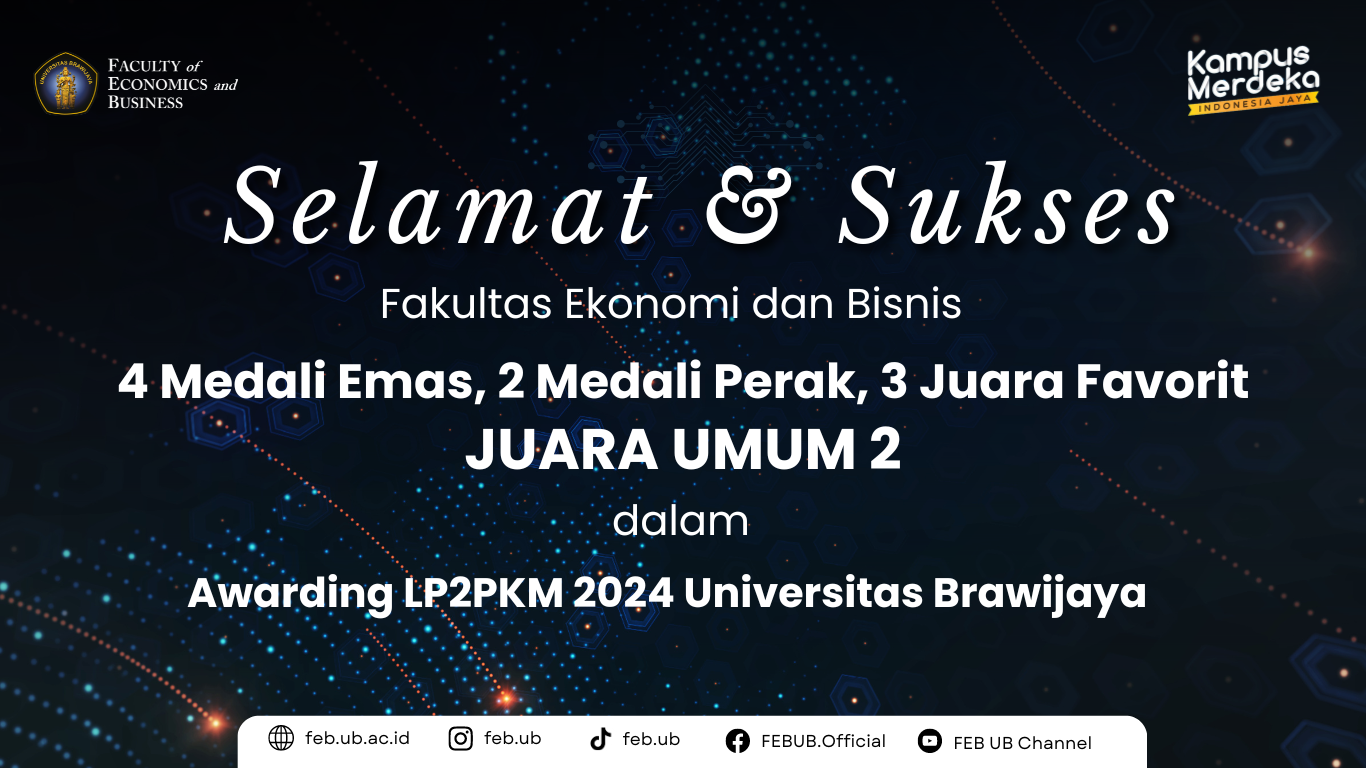

View this post on Instagram A post shared by Fakultas Ekonomi dan Bisnis (@feb.ub)

Kemitraan & Kerjasama

FEB UB FACT

DEPARTMENT

0

STUDY PROGRAM

0

LECTURER

0

STAFF

0

ACTIVE STUDENTS

0

PROFESSOR

0

FEB CARE

[wpforms id="8179"]